How to Get a Better Home Loan

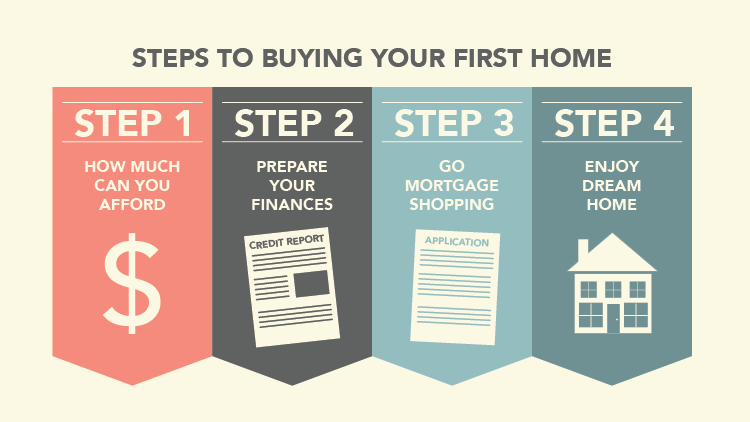

Buying a home can be exciting, but your mortgage will be a major financial responsibility for years to come. The nature of your loan will determine how much money you pay on a monthly basis, how much interest you’ll pay over the lifetime of the loan, and how long the loan will last. Choosing the right home loan is vital if you want to remain in a good financial position.

So what makes a home loan “good” and how can you get a better one?

Elements of a Home Loan

First, let’s explain the basic elements of a home loan. These include things like:

- The principal. The principal is the amount you borrow, determined by the home’s price and the amount of money you’re providing as the down payment.

- The interest rate. The interest rate determines the money you’ll owe to the bank each year, based on the principal. Generally speaking, lower interest rates are preferable.

- The term. The term of the loan is the amount of time it will take to pay off. Generally, mortgages are 15-year or 30-year; 15-year mortgages are paid off quicker, with lower total interest paid, but the monthly payments tend to be higher.

- PMI. You may also be responsible for private mortgage insurance (PMI), an additional fee if you make a down payment of less than 20 percent.

- Other expenses. If your mortgage is in escrow, it may also include payments for home insurance and property tax.

There’s some room for subjective preference on these points; for example, a 15-year mortgage isn’t strictly better than a 30-year mortgage, because it offers distinct advantages and disadvantages. However, you can always work to find the best mortgage for your preferences and needs.

How can you do this?

Improve Your Credit Score

One step to take early is to improve your credit score, since having a higher credit score may qualify you for a lower interest rate. Improving your credit score is something that takes time and discipline, so you may want to get started months before your home purchase. Start by paying down your debts and avoiding the acquisition of new debt. You’ll also want to make all payments in full and on time consistently.

Save a Bigger Down Payment

Avoiding PMI can instantly make your mortgage payment lower, so strive to save up a 20 percent down payment (at least). Start early by cutting expenses, increasing your income, and setting aside at least a few hundred dollars every month. If you’re consistent, it won’t be long before you have $10,000 or more set aside.

Shop Online

Make sure you shop for a home loan online. Thanks to the internet, you can connect with hundreds, if not thousands, of potential financial institutions. You can review their terms, interest rates, and other variables, and compare them easily, apples to apples. This is also your chance to discover banks and lending institutions you otherwise might never have known existed.

Compare Rates

Don’t choose a bank just because you’ve used them in the past or just because they had a catchy advertising slogan. Instead, compare the rates and terms offered by banks against each other. Is there one lending institution that can give you a strictly better deal?

Choose the Right Home

Your mortgage will be heavily impacted by things like terms and interest rates, but don’t forget that the entire loan is based around the principal that you’re going to borrow. Your choice of home will have a tremendous impact on your monthly mortgage payments. If you want to buy a $300,000 home instead of a $200,000 one, that’s fine—but you need to be aware that you’ll be borrowing an additional $100,000, and that can easily multiply the amount of money you owe.

Choose the Right Terms

Choose the right terms for your loan as well. At the 15-year mark, you’ll be able to pay off the loan faster, and the total interest you pay on the loan will be much smaller. However, you’ll be responsible for larger monthly payments. Conversely, a 30-year loan will take much longer to pay off, and you’ll pay more interest over time—but your monthly payments will be much smaller and more affordable.

Negotiate

Finally, consider negotiating with your lender of choice. Depending on their flexibility and the current terms proposed, you may be able to score a slightly lower interest rate just by asking for one. It never hurts to ask.

With these tips, you should be able to find a better mortgage for your next home. With a lower interest rate, more favorable terms, and (hopefully) lower monthly payments, you’ll be in a much better financial position over the long term.